The MOSFET Market Is in High Demand

As the most basic electronic devices, MOSFET has the characteristics of high frequency, voltage drive, good resistance to wear and so on. Its application scope covers power supply, frequency converter, CPU and graphics card, communication, consumer electronics, automotive electronics, industry and other fields. MOSFET is usually used in amplifying circuits or switching circuits, which can be used as switches for logic circuits and volatile circuit memory circuits, as well as amplifying signal components. CMOS integrated circuits have low power consumption and high speed. The advantages of strong anti-jamming ability and high integration are the mainstream technology of current integrated circuits. Therefore, MOSFET has become one of the important components of current integrated circuits.

China's MOSFET industry continues to develop as a whole. Data show that in 2018, the sales volume of China's MOSFET market was 93.98 billion, and the compound annual growth rate from 2016 to 2018 was 15.03%, which was higher than the average growth rate of power semiconductor industry. Assuming that the compound growth rate continues, we estimate that the domestic MOSFET market size in 2021 will be about 4.2 billion US dollars and 28 billion yuan.

MOSFET was originally necessary for power electronic devices, with relatively weak periodicity and steady growth of the industry as a whole. However, the epidemic has destroyed the normal supply rhythm and broken the normal balance between supply and demand.

China MOSFET industry chain upstream market participants are wafer, packaging materials and other raw materials suppliers and production equipment suppliers, industry chain upstream for Chinese MOSFET manufacturing enterprises, industry chain downstream application fields cover consumer electronics, communications, and automotive electronics.

The upstream market participants of China's MOSFET industry chain include wafer, packaging material and other raw material suppliers as well as production equipment for wafer procurement costs account for about 30%-40% of MOSFET costs. Currently, the tight supply of wafer worldwide causes wafer prices to continue to rise. Packaging as an important link in MOSFET device production, its cost accounts for 40%-60% of the total cost.

Companies directly downstream of the industry chain cover consumer electronics, industry, communications, automotive electronics, CPU/GPU, electronic lighting and other fields, and support many final consumer goods such as automobiles, computers, home appliances and other products through direct customers.

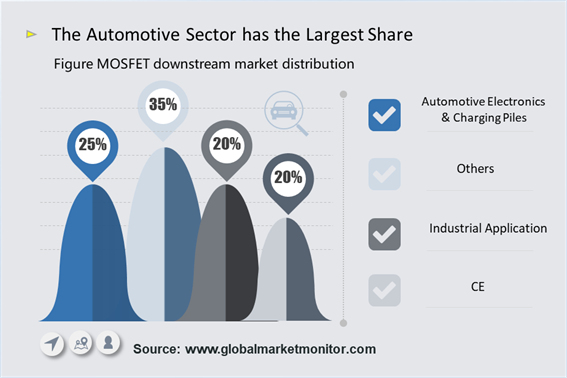

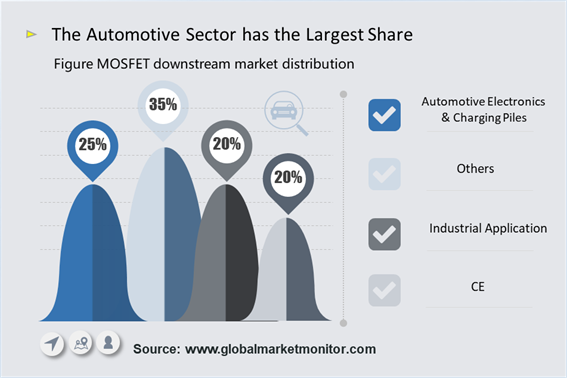

In the application distribution of MOSFET in China, automotive electronics and charging piles account for 20-30%, consumer electronics account for more than 20%, industrial applications account for about 20%, and communication equipment has been on the rise since March 2019. In the past three years, benefiting from the implementation of the national economic stimulus policy and the application of new energy and new technology, the market demand for the downstream final products has maintained a good growth trend, thus providing a broad market space for the development of MOSFET industry.

MOSFET is used to assist in driving various electric motors, including ventilation systems, windshield wipers, electric Windows, etc. The large number of electrical controls in electric vehicles will lead to a significant increase in MOSFET usage. According to relevant calculations, the semiconductor value of electric vehicles is nearly twice that of traditional vehicles. Power devices such as MOSFET and IGBT are the core components of electric vehicle motor controller to realize power conversion. In high-end electric vehicles, the amount of MOSFET devices can reach up to 250. At the same time, the popularity of new energy vehicles will further drive the demand for charging piles. As the core power device of charging piles, the sales of MOSFET will continue to rise with the increase of the distribution density of charging piles.

The specific downstream industry is more complex, we will use the 2018 industrial power control revenue breakdown of Infineon, a leading global power semiconductor manufacturer in China, as a guide to make an overview of the downstream distribution and driving forces in this field. According to the data disclosed by Infineon, we can see that household appliances, industrial drivers and power supply, and new energy applications are the main downstream applications, while the development of household appliances frequency conversion, industrial automation, and new energy power generation is the main driving force.

Industry Reshuffle with Increasing Concentration

In upstream fabs capacity remains tense situation, represented by Infineon turned to new energy field, a senior product market, low-end market blank of power devices is long-standing, this for the current implementation of import substitution in the field of mid-range MOSFET in China brings opportunities, on the other hand also accelerate the industry reshuffle.

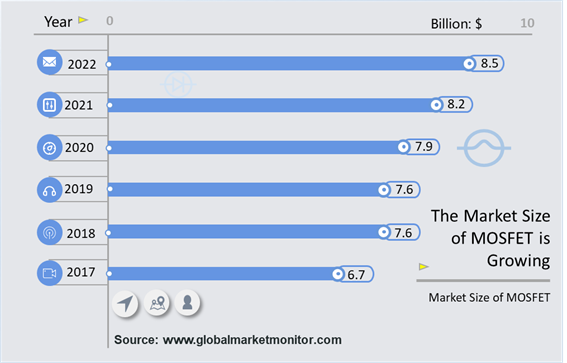

Global MOSFET shipments reached $8 billion, with China accounting for 40-50% of the market share. Policy and cost factors make many well-known international MOSFET manufacturers choose to set up factories in China, and the government attaches great importance to the development of China's semiconductor related industries. China's MOSFET industry has already occupied an important position in the international market and is continuing to do so. Fast and steady development. Under the environment of the rapid expansion of the downstream demand of China's MOSFET market, the production and marketing scale of China's MOSFET industry is constantly expanding, and the import substitution effect on foreign products is constantly highlighted. Both the quantity and amount of MOSFET imports from China show a decreasing trend year by year. In the future, as China's MOSFET industry gradually breaks through the technical bottleneck of high-end products, the dependence of China's MOSFET on imports will be further weakened, and the import substitution effect will be significantly enhanced.